south dakota sales tax rate on vehicles

Car Dealership Areas In South Dakota. Raised from 45 to 65.

Sales Taxes In The United States Wikiwand

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6.

. In addition for a car purchased in South Dakota there are other applicable fees including registration title and plate fees. Important South Dakota County Commissioners information including land assessment. What is South Dakotas Sales Tax Rate.

The South Dakota Department of Revenue administers these taxes. Several examples of of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and livestock. The cost of your car insurance policy.

South Dakota has recent rate changes Thu Jul 01 2021. For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. 4 State Sales Tax and Use Tax Applies to all sales or purchases of taxable products and services.

South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. The two taxes apply to the sales of the same products and services have the same tax rates and have. Tax Basics South Dakota Taxes and Rates State Sales Tax and Use Tax Applies to all sales.

How they apply to your business refer to South Dakota laws administrative rules and publications on our website at httpsdorsdgov or call 1-800-829-9188. Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. In addition to taxes car purchases in South Dakota may be subject to.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. 31 rows The state sales tax rate in South Dakota is 4500. Searching for a sales tax rates based on zip codes alone will not work.

Use Tax is the counterpart of the South Dakota sales tax. There are a total of 289 local tax jurisdictions across the state collecting an average local tax of 1814. Average Local State Sales Tax.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. Though you can find automotive offerings spread out in smaller towns you may have to drive into major cities of South Dakota to find car.

Applies to all sales of products and services that are subject to the state sales tax or use tax if the purchaser receives or imposes a sales tax or use tax. Motor Vehicle Repair Services. Motor Vehicles Sales and Purchases.

South Dakota Taxes and Rates. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax.

Average Sales Tax With Local. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The South Dakota DMV registration fees youll owe.

Average DMV fees in Kentucky on a new-car purchase add up to 21 1 which includes the title registration and plate fees shown above. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Additionally if you want to avoid surprise maintenance costs after buying a used car you should think about ordering a vehicle.

Click here to get more information. Tax Rate State sales tax 45 2115 Rapid City sales tax 2 940 Tourism Tax 15 705 Motor Vehicle Gross 45 2115 TOTAL DUE 52875 Fees charged for driving a motor vehicle from one location to another are subject to sales tax or use tax. Any titling transfer fees.

Motor Vehicle Sales or Purchases. Get all the information you will need to title or renew your vehicle registration and license plates for your government vehicles. South Dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1814 on top of the state tax.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. The cost of a vehicle inspectionemissions test. The excise tax which you pay on vehicles in south dakota is only 4.

State sales tax and any local taxes that may apply. Municipalities may impose a general municipal sales tax rate of up to 2. Select the South Dakota city from the.

The following tax may apply in additionto the state sales tax. However if purchased by an out of state business you will need to show proof of tax paid to your local Department of Revenue office. Simplify South Dakota sales tax compliance.

With local taxes the total sales tax rate is between 4500 and 7500. Sales Tax Rates by Address. What Rates may Municipalities Impose.

The state sales tax rate in South Dakota is 45 but you can customize this table as. Only some sd counties mandate the. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. The South Dakota sales tax and use tax rates are 45. This means that an individual in the.

Click Search for Tax Rate Note. 2 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases. This means that depending on your location within South Dakota the total tax you pay can be significantly higher than the 45 state sales tax.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. Oil Gas Field Services. While south dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Car Sales Tax In South Dakota Getjerry Com

States With Highest And Lowest Sales Tax Rates

What S The Car Sales Tax In Each State Find The Best Car Price

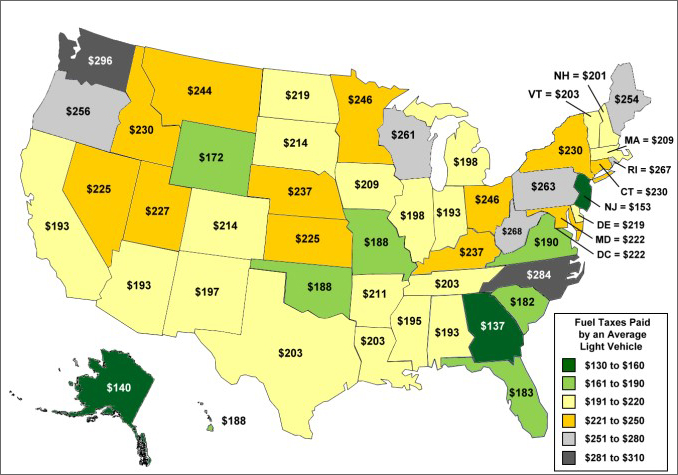

Fact 794 August 26 2013 How Much Does An Average Vehicle Owner Pay In Fuel Taxes Each Year Department Of Energy

Sales Taxes In The United States Wikiwand

South Dakota Sales Tax Small Business Guide Truic

Retirement Taxes By State 2021 Retirement Benefits Retirement Paying Taxes

2009 Ford Edge For Sale In Frankfort Il Offerup Ford Edge Ford Frankfort

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Caddyshack Golf Carts Mini Mustangs Cobras Raptors Golf Carts Golf Car Golf

Klassen Mercedes Sprinter Custom Luxury Van Luxury Cars Rat Rod

10 Most Innovative Camper Vans Motorhomes 2020 2021 Youtube In 2021 Camper Van Motorhome Camper

Car Sales Tax In South Dakota Getjerry Com

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

A Complete Guide On Car Sales Tax By State Shift

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price